Services

Introduction

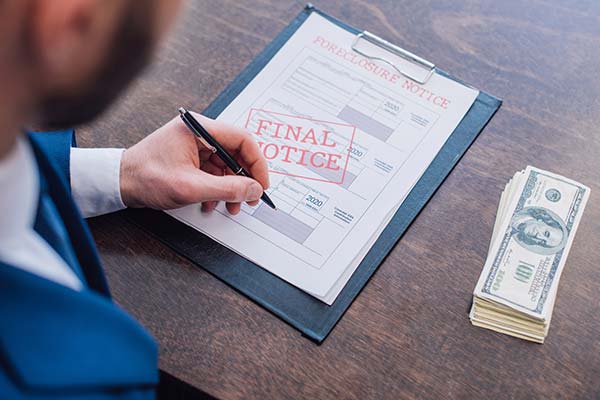

At JLS Law, we can provide guidance on filing for bankruptcy protection as a legal tool to put an immediate stop to foreclosure sales. Bankruptcy offers a powerful shield that prevents creditors, including mortgage companies, from proceeding with foreclosure proceedings. It provides you with the opportunity to catch up on missed mortgage payments over a reasonable period of time, giving you the chance to regain control of your financial situation. Our experienced attorneys will guide you through the bankruptcy process, ensuring that your rights are protected and that you have the best chance of preserving your home. Contact us today to learn more about how bankruptcy can help you stop foreclosure and secure your home.

Bankruptcy

Bankruptcy plays a significant role in preventing creditors, including mortgage companies, from proceeding with foreclosure proceedings. When an individual files for bankruptcy, an automatic stay is put into effect. The automatic stay is a court-ordered injunction that immediately stops all collection actions, including foreclosure proceedings, against the debtor.

The automatic stay provides a temporary halt to the foreclosure process, giving the debtor the opportunity to address their financial difficulties and explore options to save their home. This stay remains in effect throughout the bankruptcy case, providing the debtor with much-needed breathing room to develop a plan to manage their debts.

During the bankruptcy process, the debtor may choose to file for Chapter 7 or Chapter 13 bankruptcy. In Chapter 7, the debtor's non-exempt assets are liquidated to repay creditors, and any remaining unsecured debts are discharged. In Chapter 13, the debtor creates a repayment plan to pay off their debts over a period of three to five years.

Regardless of the bankruptcy chapter, the automatic stay remains in effect until the bankruptcy case is resolved or the court grants relief from the stay. This provides the debtor with an opportunity to negotiate with the mortgage company, catch up on missed payments, or explore other alternatives to foreclosure.

Overall, bankruptcy acts as a powerful tool to prevent foreclosure by imposing an automatic stay, allowing debtors to regain control of their financial situation and potentially save their homes. It is important to consult with a qualified bankruptcy attorney to understand the specific implications and options available in your situation.

Modification

Bankruptcy plays a significant role in preventing creditors, including mortgage companies, from proceeding with foreclosure proceedings. When an individual files for bankruptcy, an automatic stay is put into effect. The automatic stay is a court-ordered injunction that immediately stops all collection actions, including foreclosure proceedings, against the debtor.

The automatic stay provides a temporary halt to the foreclosure process, giving the debtor the opportunity to address their financial difficulties and explore options to save their home. This stay remains in effect throughout the bankruptcy case, providing the debtor with much-needed breathing room to develop a plan to manage their debts.

During the bankruptcy process, the debtor may choose to file for Chapter 7 or Chapter 13 bankruptcy. In Chapter 7, the debtor's non-exempt assets are liquidated to repay creditors, and any remaining unsecured debts are discharged. In Chapter 13, the debtor creates a repayment plan to pay off their debts over a period of three to five years.

Regardless of the bankruptcy chapter, the automatic stay remains in effect until the bankruptcy case is resolved or the court grants relief from the stay. This provides the debtor with an opportunity to negotiate with the mortgage company, catch up on missed payments, or explore other alternatives to foreclosure.

Overall, bankruptcy acts as a powerful tool to prevent foreclosure by imposing an automatic stay, allowing debtors to regain control of their financial situation and potentially save their homes. It is important to consult with a qualified bankruptcy attorney to understand the specific implications and options available in your situation.

Forberance

Trust Our Expertise to Obtain a Temporary Restraining Order:

Our experienced attorneys will skillfully negotiate with your mortgage company, presenting compelling legal avenues that can put a stop to the foreclosure process. By offering a well-crafted forbearance plan, we aim to convince the mortgage company to accept a good faith payment, giving you the opportunity to catch up on missed payments over time.

Temporary Restraining Order (TRO)

When unfair foreclosure looms, we don't hesitate to take swift legal action on your behalf. Our attorneys will file a lawsuit against the mortgage company in state court, seeking a temporary restraining order. By presenting your case before a judge, we will fight to halt the foreclosure process, giving you the breathing space you need to explore alternatives and regain financial stability.

.png)